omaha ne sales tax rate 2019

Wayfair Inc affect Georgia. Nebraska Department of Revenue.

Sales Taxes In The United States Wikiwand

There is no applicable county tax or special tax.

. Groceries are exempt from the Nebraska sales tax. Click here for a larger sales tax map or here for a sales tax table. March 1 2019 Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019.

Visit the Avalara Nebraska state guide to learn more about sales and use tax in Nebraska. You can print a 55 sales tax table here. Plattsmouth NE Sales Tax Rate.

This is the total of state county and city sales tax rates. Local sales and use tax increases to 2 bringing the combined rate to 75. Effectively Pender will not have a local sales and use.

The Omaha sales tax has been changed within the last year. Local sales tax. Did South Dakota v.

It was lowered 05 from 825 to 775 in July 2022 raised 05 from 775 to 825 in July 2022 lowered 05 from 825 to 775 in June 2022 raised 05 from 775 to 825 in June 2022 lowered 05 from 825 to 775 in May 2022 raised 05 from 775 to 825 in May 2022 lowered 05 from 825 to. The Georgia sales tax rate is currently. What is the sales tax rate in Omaha Nebraska.

Omaha collects the maximum legal local sales tax The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax. For the upcoming quarter starting on January 1 2019 the current 1 sales and use tax for Pender will terminate. North Platte NE Sales Tax Rate.

Omaha ne sales tax rate 2019 Saturday March 19 2022 Edit. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state. The County sales tax rate is.

This is the total of state county and city sales tax rates. Did South Dakota v. For tax rates in other cities see Texas sales taxes by city and county.

The Nebraska state sales and use tax rate is 55 055. The local sales tax rate is 1 percent in Eagle and Greenwood. Papillion NE Sales Tax Rate.

Also effective October 1 2022 the following cities. Combined with the state sales tax the highest sales tax rate in Nebraska is 8 in the city of. 15 percent in Omaha Ashland Bellevue Bennington Blair.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. There is no applicable city tax. You can print a 825 sales tax table here.

Sales tax guide for Nebraska businesses. Wayfair Inc affect Nebraska. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825. Nebraska sales tax changes effective July 1 2019 Several local sales and use tax rate changes take effect in Nebraska on July 1 2019.

The Nebraska NE state sales tax rate is currently 55. For tax rates in other cities see Georgia sales taxes by city and county. The County sales tax rate is.

The Nebraska state sales and use tax rate is 55 055. There is no applicable special tax. Ralston NE Sales Tax Rate.

Lawmakers are questioning a proposal that would raise Nebraskas state sales tax and steer the extra revenue into tax credits for low-income residents and property owners. The minimum combined 2022 sales tax rate for Omaha Georgia is. Schuyler NE Sales Tax Rate.

However as a result of an affirmative vote in the November 6 2018 election Pender will impose a new city sales and use tax at the rate of 15 but it will not be effective until April 1 2019. 05 lower than the maximum sales tax in NE. Omaha NE Sales Tax Rate.

Nebraska sales tax details. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. You can print a 8 sales tax table here.

Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax while the city of St. Norfolk NE Sales Tax Rate. As of January 1 2019 Nebraska requires certain out-of-state businesses to collect and remit Nebraska sales tax.

Offutt Air Force Base NE Sales Tax Rate. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax. You can print a 7 sales tax table here.

The Nebraska sales tax rate is currently. Nebraska City NE Sales Tax Rate. The Omaha sales tax rate is.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. Sales tax rates rules and regulations change frequently. The Omaha sales tax rate is.

Omaha collects the maximum legal local sales tax The 8 sales tax rate in Omaha consists of 4 Georgia state sales tax 3 Stewart County sales tax and 1 Special tax. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. For tax rates in other cities see Nebraska sales taxes by city and county.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. Edward will increase its sales and use tax rate by 15. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

The Million Dollar Penny Rare 1943 Lincoln Cent Bought By Owner Of The Texas Rangers For A Cool 1million Valuable Coins Most Expensive Penny Valuable Pennies The Nebraska state sales and use tax rate is 55 055.

Sales Taxes In The United States Wikiwand

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Sales Taxes In The United States Wikiwand

2020 The Year Of The Roth Ira Conversion Lutz Financial

What Are The Rationales Behind Raising Taxes Like Left Wing Politicians In The Us Tend To Do And Lowering Taxes Right Wing Which Works Better Quora

Sales Taxes In The United States Wikiwand

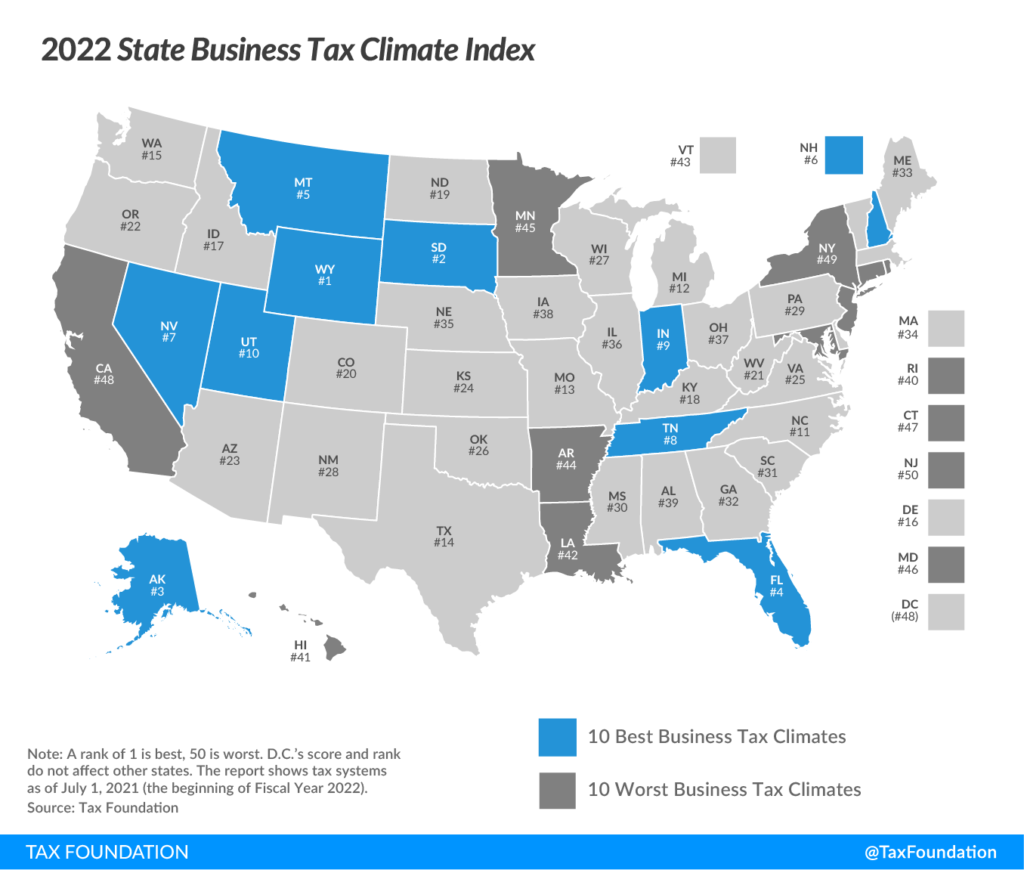

Nebraska Drops To 35th In National Tax Ranking

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Sales Tax On Cars And Vehicles In Nebraska

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates